Lesley-Anne Scorgie is the founder of MeVest, a money school helping Canadians reach their financial potential. She’s also the bestselling author of Well-Heeled: The Smart Girl’s Guide to Getting Rich and Rich by Thirty: Your Guide to Financial Success. At the age of 10, she started to invest money she earned through babysitting. Initially, Scorgie purchased Canada Savings Bonds and then started buying mutual funds when she was 14. This interview took place at the Toronto Reference Library on April 19, 2018 (Thursday @ 1900). The duration of the interview was 21 minutes and 39 seconds.

Urgen Kuyee: Hi Lesley-Anne, why don’t you let my readers know a little bit about yourself? Which school did you go to? How did you get into personal finance?

Lesley-Anne Scorgie: I did my undergraduate degree at the University of Alberta in Edmonton and that was, oh my gosh quite a few years ago. I graduated in 2005. I ended up returning to school again in 2012 to do my MBA with Queen’s University. I got interested in personal finance well before my university years ago. I was very keen on it at the age of 10 and bought my first Canada Savings Bond. It was really a way to the races from that point forward when I realized I had the power to save money and to do it on my own. So, it started with babysitting money and then it moved into money I was earning from my part-time job at the library. And, before I knew it I had built up quite a bit of savings just at time to go to university in 2005. That’s how I got started, I found it motivating and I am sure your readers also know that feeling that you get when you start to see your money grow. It’s exciting. So, that’s what kept me going. It was excitement.

UK: Could you tell us more about MeVest? When did you start the company and more importantly, why did you start it?

LAS: MeVest is focused on money coaching. We help Canadians and a lot of younger Canadians that are just out of school into their first or maybe even their second jobs.

UK: Is it more of a millennial crowd?

LAS: Well, we do attract a lot of millennials but well beyond millennials. We attract a lot of women and couples that are well into their forties and fifties nearing retirement. What we do is offer independent financial counselling to people that want to start achieving more with their money. So, it’s an integration of the financial planning process. MeVest was inspired by years of me looking at the situations that people were finding themselves in, writing into my column, asking for advice and in 2014, I started the company, MeVest. And, kicked it off and now, we are one of Canada’s leading money coaching practices.

UK: You have offices only in Toronto or is it all over the country?

LAS: We have a really unique model. We actually work virtually. So, it’s awesome and allows flexibility for a team but it’s the way a lot of our clients want to meet with us and share their documents. We have got such great technology and tools now as a society. You look at the ability to share documents on google, you can share on skype. So, we use the tools that are available to everybody to deliver our service. That’s what keeps our cost low. (Laughs)

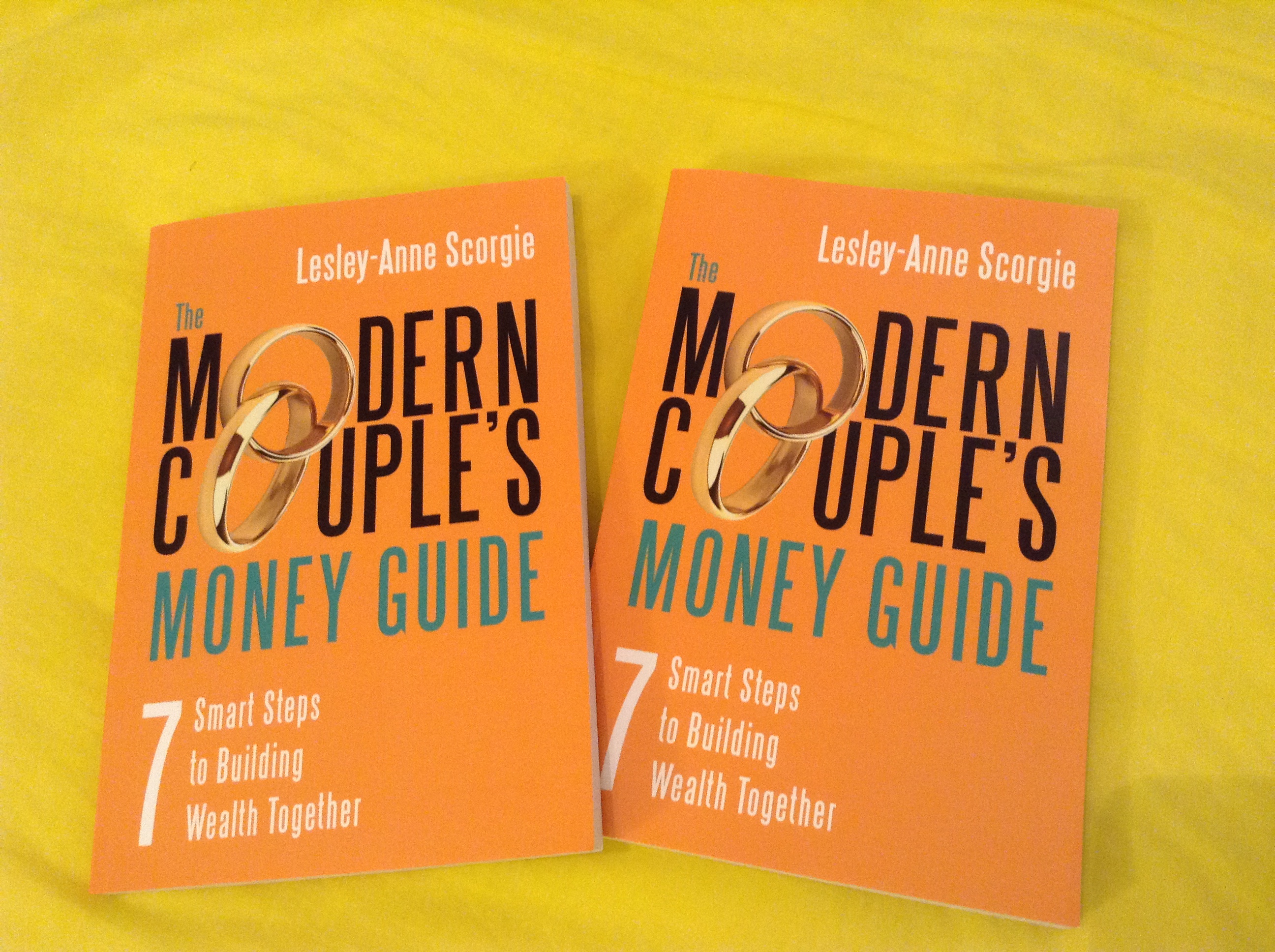

UK: Let’s talk about your book, The Modern Couple’s Money Guide. What led you to write this book?

LAS: Modern Couple’s Money Guide was inspired by our couples that we serve in MeVest. Also, my own situation and looking at the most important things that couples need to talk about when they are forming a union. So, hopefully before they get married. (Laughs) But often times, it’s after they get married that they start talking about their finances. Modern Couple’s Money Guide focus is the conversation on what’s absolutely most important for couples and that is agreeing upon a budget. Being positive about their money together and making a plan. When our couples are actively making a plan together and joint budgeting and cheering each other on, we see great results.

Challenge for couples that aren’t talking about money is there can be different priorities showing up in the bank account. That is not a great way to be. It’s what causes trouble in a marriage because when one person is spending in a way that maybe compromise the financial security of the couple, it demonstrates lack of care and you know, trust issues and many other issues. One thing to remember is that money issues with couples are not about money. They are exclusively about behaviours, attitudes and beliefs.

UK: In your book, you talk about how couples face the choice of joining their finances together or continuing to operate independently. What are some of the benefits of having a joint account? What are some of the drawbacks?

LAS: Joint accounts offer transparency so both parties can see what’s going into and out of the bank account. That’s one of the biggest benefits. Second to that is reduced fees. So, fewer accounts means fewer service fees and that can add up to many hundreds of dollars in the course of a year.

The drawbacks are a sense of pooled money being more money and that is not the case. That’s the exact same amount of money, it just happens to be in one account versus two. Then, there is the very rare situation where I hear people say, “Well, what if my partner runs away on me with all of my money?” to which I respond maybe you need to talk to a counsellor because it sounds like there’s some other issues there around trust. Certainly, that can be an issue but it all gets resolved in court later on.

UK: I know you spoke about this before, maybe a couple of years ago but do you still think women should be saving more than men?

LAS: Absolutely.

UK: Why?

LAS: Okay, let me tell you three reasons why women need to save more. The first is that they live longer, up to 10 years longer than men.

UK: I work as a nurse so I can back your statement.

(Dear reader, I know what you are thinking. “Urgen, gosh, you are so smart.”)

LAS: Yes. The second is that when financial planners told us 15-20 years ago, we all needed to save 10%, they assumed that women would be in a partnership, in a marriage. We know that 50% of women dissolve their marriages and do not have access to the same amount of money that they once had. The third reason which is the one that really annoys me is in Canada, we still experience the gender pay gap. We have many years worth of work as a country, as a society, as organizations and as a government to fix that problem. It’s wrong. It will get fixed but it is not fixed right now.

UK: What are one to three books that have greatly influenced your life?

LAS: I was talking about this, this morning. Well, the very first personal finance book that I ever read was The Wealthy Barber.

UK: I have interviewed several authors and The Wealthy Barber comes up again and again.

LAS: Yes, everybody. I think because of the time it was one of the few personal finance books that was mainstream. And, shortly there after, David Bach came out with The Automatic Millionaire, which I also found quite inspiring. I don’t read a lot on personal finance anymore probably because I write about personal finance so often. These days I’m enjoying a lot of nonfiction and books that are building my leadership and teamwork. One of my favourites this year is One Small Step Can Change Your Life. It’s a kaizen way of approaching challenges in your business and in your life, breaking them into small pieces so that you can achieve or overcome a challenge. So, that I found very inspiring.

UK: Who is the author?

LAS: I can’t remember the name of the author. But, it’s actually physically a very small, little book with very snackable tidbits of advice that allow you to break these challenges down into small pieces. We actually ran a feature on our newsletter few months ago and we have sent it out to our followers to just suggest what a great way to approach any kind of challenge and break it down into small parts.

UK: Your financial articles have appeared in publications such as Metro News, Toronto Star, Men’s Health magazine and the Globe and Mail. What is your writing practice like? Do you prefer writing in the morning, daytime or night time?

LAS: I am a morning writer. I find that by the end of the day I am a little too fatigued. I find that my zone where I am in the best creative flow is usually between 7:30 and 10:30 in the morning. So, you will often find me not booking many meetings during that time. One thing that I learned from my business coach this past year was to protect that creative time fiercely because people will always take it from you and book meetings for business or whatever. And, if you can protect that important zone you are going to be able to produce great writing, great video, great whatever it is that you’re working on.

UK: How many times do you write in a week?

LAS: I publish every week with star media, which recently acquired and took over metro news. And likely you know two to three other times per week. I have some other kind of media going on with Breakfast Television or CBC.

UK: Where do you get your ideas from?

LAS: I listen to my followers what they are talking about and what’s current in the market. Right now for example, we are talking a lot about scholarship season because April, May, June are when scholarships are some of the biggest in Canada and their application deadlines are. So, we are talking about that. We are talking about the things that are on the minds of our followers. Sometimes, it’s budgeting, sometimes it’s scholarships, other times it’s investments and other times it’s how to have a conversation with your partner about money.

UK: I am aware you love working out. How does staying physically fit help you to get more things done, be more creative or be more productive?

LAS: I go and work out 6 days a week.

UK: Wow.

LAS: It is key to my mental health and it doesn’t mean that I’m spending a ton of time in the gym. I am very efficient when I’m down there. You know 35 to 50 minutes is generally all that I am going to get in the gym. What it does is it actually improves the flow of oxygen into your brain and that makes you a better thinker. More oxygen, more blood flow, better breathing and all of that brings brainpower but it also brings calm power. And for anyone that has ever experienced anxiety or quickness of breath, you know how important that breathing is. Also, you sleep better and sleep is really important for the brain. So, I don’t see a life for myself where I can’t have that physical activity because it allows me to create the balance between my work and my wellness. It’s also the same set of skills that you need for your finances. (Laughs)

UK: I agree with you one thousand percent.

LAS: Discipline, regular, contribution. It’s very much the same.

UK: How long have you been doing this for, like working out 6 days a week?

LAS: Well, I became a fitness trainer four years ago.

UK: Oh, you are a fitness trainer as well? That didn’t show up in my research.

LAS: I am because I absolutely loved group fitness and I loved my community of people that I would do group fitness with. So, I got my side hustle on and I figured if I was going to be at the gym six days a week, I might as well get paid for it. Needless to say, I have been doing fitness formally for four years but before that, I have always been an active person, always been doing fitness.

UK: Let’s get back to money again. A 27-year-old nurse makes about 65K/year and wants to save about 10 percent yearly for her retirement. Would you tell her to go with a TFSA or an RRSP?

LAS: That’s a really tough one. We recommend when you make less than $55,000, we recommend the TFSA as the primary tool. Over 55,000, we recommend RRSPs as a primary tool but the big difference in the case that you just presented me is that often times our healthcare professionals have access to a pension plan. That pension plan is very powerful. So, this exception, we would recommend a nurse go to a TFSA because the nurse already has a very robust pension plan which serves very similar purpose to the RRSP.

UK: How do you invest your money? Do you mind sharing what’s in your portfolio today?

LAS: Ya. I used to invest very high risks. (Laughs) I used to be big into the oil and gas business partially because I used to work in that business. As I have grown in my investment knowledge, I have actually really shaved my portfolio to be a socially responsible portfolio. It meant that I removed things from my portfolio that harmed the environment. Oil and gas, anything that had high carbon footprint, bad track records of protection of human health or the environment. So, it all got stripped from my portfolio and that process took almost a year to like really refine my portfolio. Today, I got a nice chunk of bonds, corporate bonds, I have some real estates, and then I have some fun in my portfolio. (Laughs more) When I say fun, I am big into fashion. I love brands you know like Lululemon and Canada Goose. So, I have some of those fun companies in there as well as my blue chips.

UK: Lastly, what are bad recommendations you hear in your profession or area of expertise? What advice should Canadians ignore?

LAS: One that troubles me right now is the conversation around fees and investing. And why it troubles me is investors need to look at fees and performance. So, the latter part of that has been forgotten lately especially with our young millennials and that language needs to change because both aspects are important. I find that a little bit annoying. I would say that it is bad advice if somebody only talks of fees or only talks of performance. Those two things need to be brought together. The other thing that I sometimes hear and this was horrifying because one of my young client told me recently that she had gone into her bank to set up her account structure. And, the banker told her you are too young, go and have some more fun before you open your RRSP. That’s bad advice. (Laughs)

UK: Wow, that’s bad.

LAS: The bank will remain nameless but that advice would unfortunately influence somebody who is just getting started and what I want to say to counter that is start as early as possible because it sure lightens the financial load later on. When you think about retiring or if you wanted to buy a property eventually.

UK: Ya, time is your best friend.

LAS: Ya, for sure.

UK: Thank you so much for your time, Lesley-Anne.

LAS: Thank you.

This interview has been edited and condensed.

Good article. I’m already retired & am one of the lucky people with both my husband & I having guaranteed pension plans. And I was always a great saver & fairly low spender. But one of these books would be great as a a gift for my children! Thank you!

Hi Alice, happy for both you and your husband. I have one more copy so I can give it you as a gift for your children. Please send me an email or contact me via my contact page.

I agree with her when she says protect your creative time fiercely. People will always take it from you for both good and bad reasons. Don’t take advice from bank tellers 98% of the time.

Yes, always remember banks are not your friends and they are there to sell their products. But, buy/own equities of the bank as they go beyond to take care of their shareholders, not their customers.