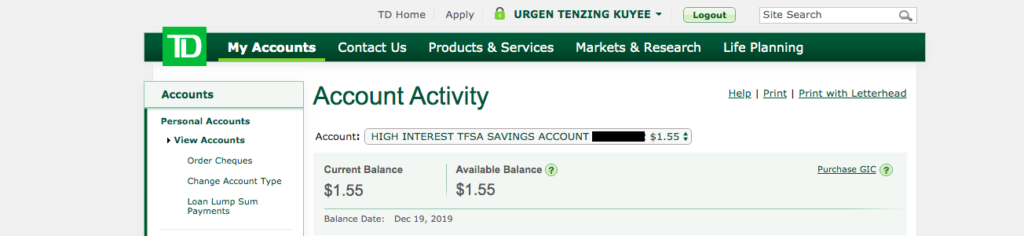

A confession. When I don’t visit gentlemanly websites, I am usually more creative and productive. I tend to write more, I tend to blog more. I tend to read more. I tend to watch less Netflix. When I am done with a 36 hour water fast, my mind is clear and I feel light. When I am surrounded by toxic nurses at work, I feel queasy. When my crush reads my message on WhatsApp (You know, the two blue tick marks) and does not respond for 48 hours, I tend to cry. Most crucially, when I see how much interest I am earning from my bank for my high interest savings account, I break down and sob like a child.

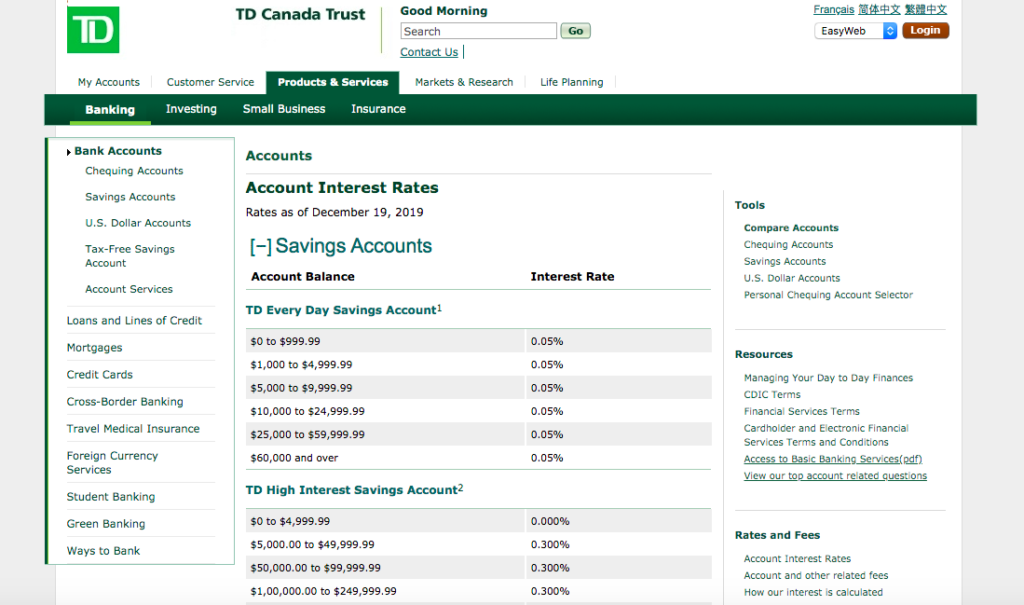

Do me a favour: Stop reading this blog post. Log into your bank account right now and cash out all your money if the interest rate is 0.05% on your savings account.

Let me warn you: Savings accounts are generally not ideal for long term plans like your retirement. You have to invest in the stock market for significant capital growth. But, if you do want to stock away some cash for short term plans such as buying a car, vacation, wedding, down payment for a condo, et cetera a high-interest savings account (HISA) can be of immense help.

Further, a HISA isn’t like a GIC where your money is non-cashable. You can cash out your money at any time. This is the principal reason why I believe some HISAs are better options than GICs as you will find out you can earn more interest from some of the HISAs and your money is not trapped.

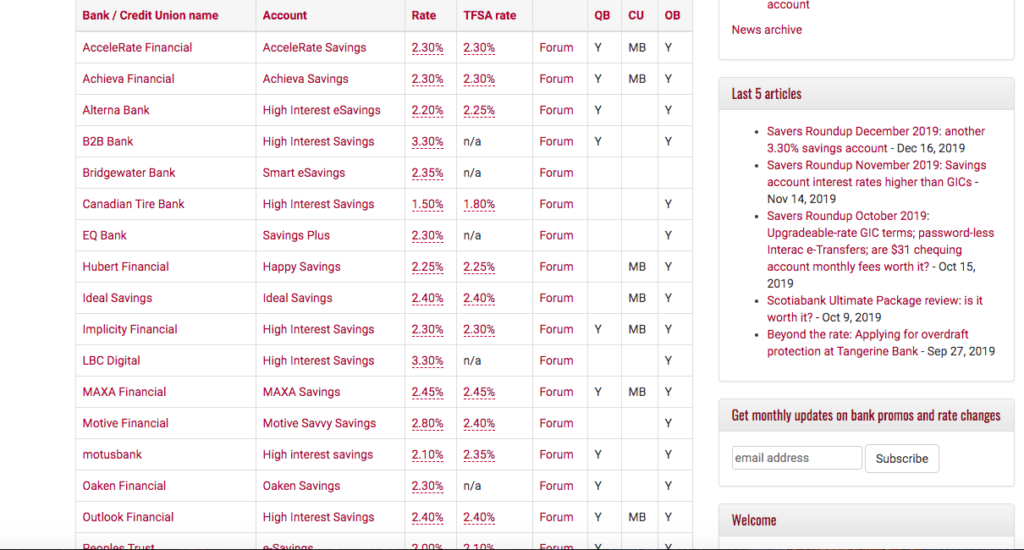

Below are some of the best high-Interest savings accounts in Canada in 2019.

Laurentian Bank of Canada (LBC Direct) Digital High-Interest Savings Account

When I saw this account, I wanted to make love with it. I vividly remember about three years ago, EQ bank made some noise by pitching in an attractive 3%. The Laurentian Bank of Canada (LBC) is offering 3.30%. Canadians haven’t seen this kind of interest rate in years. Additionally, there is no minimum balance requirement or monthly account fees. More crucially, LBC direct savings account is protected by CIDC.

B2B Bank High-Interest Savings Account

Competition is always good. We need options. The more, the merrier. For you and me, we need different players in the industry and we can pick the one we like. B2B Bank is the other player in the industry that offers 3.30% interest on their savings account. Yum. In a similar vein, there is no minimum balance requirement or monthly account fees. Likewise, B2B Bank savings account include CDIC insurance.

I have included EQ bank because I have an account with EQ bank. EQ bank does not offer 3.30% on their savings account but I would argue it currently offers one of the best high-interest savings account rates in Canada.The EQ Bank Savings Plus Account currently offers a competitive interest rate of 2.30% and requires no minimum balance to open an account. EQ bank is covered by CDIC akin to both the banks mentioned earlier. Unfortunately, EQ Bank is not available in Quebec.

In the crowded personal finance space, this website – highinterestsavings.ca stands out when it comes to comparing different Canadian high interest savings account rates. Take a look and choose the best one.

Pop Quiz.

Q: Toronto Raptors are the world champs. Do you jump on the bandwagon?

A: YES.

Q: LBC is offering 3.30% on their savings account? Do you jump on the bandwagon?

A: YES