Consider yourself warned: Do you have student loan debt? Do you have credit card debt? Further, your OSAP is not paid off yet? Please stop reading this blog post. Heck, close this window asap. When I say get more credit, it comes with a huge caveat. Do this only if you have no debt. This tip is not for everyone.

I will admit: Paying off my OSAP was difficult. I vividly remember my first year working as a nurse (Side note: I also did a bit of freelance writing with meager pay), a bulk of my pay would go straight towards OSAP. Was it worth it? Absolutely. When I received the mail saying my OSAP has been cleared, I giggled like a nine-year-old girl when she sees her crush. I am mentioning OSAP because most of us have some kind of student loan debt. In a similar vein, I would add most of us have some kind of credit card debt as well.

Why you should get more credit?

I know what you are thinking. This is contradictory, absurd, senseless and faulty. I don’t like this Urgen guy anymore. These are the kinds of things that my nursing colleagues discuss, voluntarily and with gusto over lunch. Before I explain, you should get more credit only if you have no debt and pay your bills in full each month. Please forgive me for repeating, but this is important.

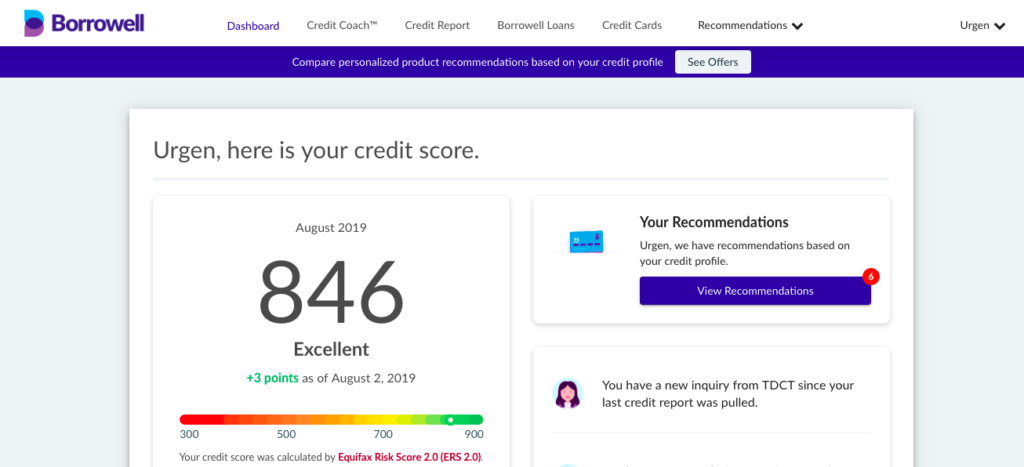

You should get more credit because getting more credit improves something called your credit utilization rate. Credit utilization rate is how much you owe divided by your available credit. A simple math example will help. An example would be you have a credit card limit of $10,000 and if you owe $5000, your ratio is 50%. This is not good. According to the Financial Consumer Agency of Canada (FCAC), they suggest it is best to use less than 35% of your available credit. So, if you owe only $1000 and have $10,000 in your available credit, your credit utilization rate is a much better 10%. YUM. Lower credit utilization rate is preferred because your credit card issuers don’t want you to spend the total available credit and not pay them back.

Credit card utilization rate is important because this is the second core principle related to influencing your credit score as this makes up about 30% of your credit score. The chief factor influencing your credit score is your past payment history which makes 35% of your credit score.

A high credit score can save you tens of thousands over your lifetime especially when it comes to getting a better mortgage rate. Think GTA housing price. A couple of my nursing colleagues go online for hours to get the best deals on travel or clothes. They yell with enthusiasm after saving $25, let them brag, let them say “I told you so” but you will be smiling inside as now you know, you will be saving thousands of dollars by having a lower credit utilization ratio and ultimately, a better credit score. Ramit Sethi, a New York Times Bestseller tells his readers to focus on the Big Wins. I concur. Improving your credit score is worth much more than saving 4$ on your morning latte, spending multiple hours to save $50 on your iPhone and (gasp) planning ahead so you can go for your soccer game, then hop back into the subway within 2 hours because your transfer is valid for 2 hours. This way you can save $3.10 on your Presto card. Jesus. Who are these people? Fuck. I am not going to lie to you: I always plan ahead when I go to my soccer games so I can hop back into the subway within 2 hours. LMAO.

How can you improve your credit utilization rate?

Easy. Increase your total available credit. Call up your credit card company and ask for a credit increase. Personally, I request a credit-limit increase every twelve to eighteen months. As I have noted earlier, you should get more credit only if you are debt free. Another obvious trick would be to carry as less debt as possible on your credit cards.

Fun fact: Approximately 42% of adults say knowing someone’s credit score would affect their willingness to date that person. To be fair, it makes sense to me. Silliness aside, I hope I have persuaded you that increasing your credit limit can be beneficial. Sure, this sounds counterintuitive. Of course, there will be a predictable group of naysayers. Make no mistake, if you have credit card debt or student loan to pay back, I understand and it is hard. I was there myself three years ago paying OSAP. However, some blindly argue everyone has credit card debt or OSAP to pay off and this is normal. I believe this is where most of us has arguably done the most damage. Imagine saying the same thing and paying debt even during your retirement. I can’t fathom the idea of paying debt during my retirement. Neither should you.

The more constructive question is: How can we do better and pay off our debt diligently?

Thank you so much for these great tips!!! 🙂

I increased my credit limit last summer as I thought I would need it in case of an emergency haha. However, the teller didn’t mention anything regarding credit score and so on.

I am amazed by your knowledge of personal finance! Excellent work! 🙂

Thank you Amanda. I am glad you enjoyed the tips. Yes, bank tellers don’t help much xd