Say it with me: TFSA should be used as a savings account.

I am kidding. Of course, there is no one way to use your TFSA – just as there is no one way to parent a child, write a blog post or bake poop cookies. Yep, you heard me right. Before you read on, google poop cookies. Ew. Yum. I will let you decide. I recognize that millennials use their TFSAs differently. Some use it as a high-interest savings account, a few may use it as a savings account for an emergency fund, and others may use it as an investment account for retirement.

Not sure what is a TFSA?

TFSA stands for Tax-Free Savings Account. In 2009, the Government of Canada introduced the Tax-Free Savings Account (TFSA) to help Canadians save money. Canada Revenue Agency (CRA) says this, “It is a way for individuals who are 18 and older and who have a valid social insurance number to set money aside tax-free throughout their lifetime. Contributions to a TFSA are not deductible for income tax purposes. Any amount contributed as well as any income earned in the account (for example, investment income and capital gains) is generally tax-free, even when it is withdrawn.” Put another way, if you have a billion dollar in your TFSA today and want to withdraw your money, you get to keep your billion dollars.

Calm down, amigo. Not so fast.

That was only a hypothetical case. Here’s the truth: The maximum amount that you can contribute to your TFSA is limited by your TFSA contribution room. If you were 18 in 2009 and have contributed nothing, you’ve got a delicious $63,500 of contribution room as of January 1st, 2019. Also, if you are this person, please reconsider your life choices.

The new 2019 TFSA got even better with a contribution limit increase to $6,000 from $5,500 in 2018. Millennials like me applauded the move. What’s more, you can have as many TFSA’s as you want. I need to add a small caveat: you need to stay within your lifetime TFSA contribution limit. Personally, I have two TFSAs myself. One with TD bank for my TD e-Series and another with Questrade for my individual stocks’ portfolio.

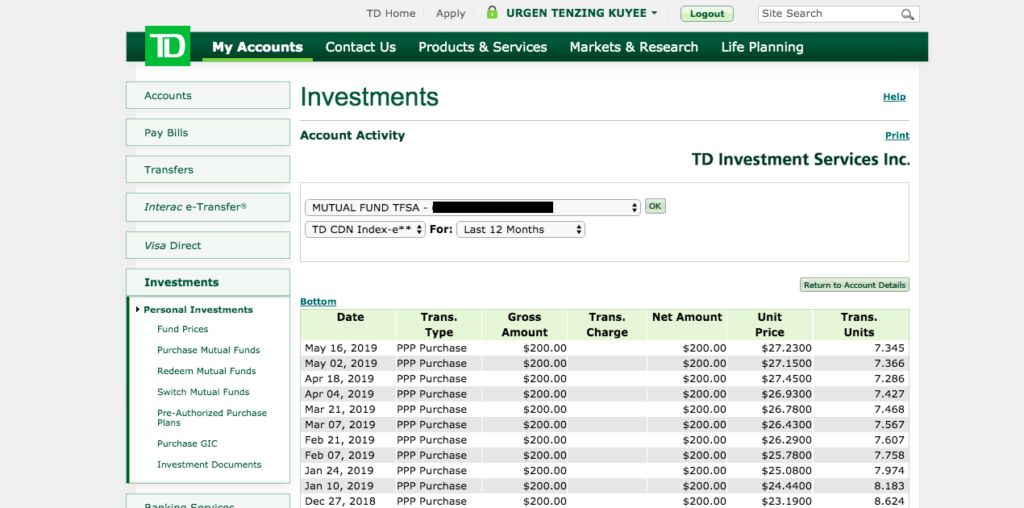

If you think, investing $200 bi-weekly is too much. I get it because I have been in the same boat. You can start with as little as $25/month. Heck, that’s how I started initially nine years ago. Then, I increased it to $50/month, $100 bi-weekly and now, I invest $200 bi-weekly. I am thinking of increasing it to $300 bi-weekly very soon. Alas, if you think investing $200 bi-weekly is for losers. Good job, I am happy for you. I lied. I hope you fall off a sea cliff and become shark food.

Here’s a small treat for you, not for the shark. If you have not yet, it is essential to open up your online account with Canada Revenue Agency (CRA). CRA has multiple tabs on their dashboard. One of them is the RRSP and TFSA tab. When you click on it, it shows your yearly TFSA contribution room, transaction summary, TFSA returns and records. This way you know exactly how much you can contribute, you will also be aware if you made a withdrawal from your TFSA, et cetera. Equally important, you will be aware not to over-contribute to your TFSA and avoid unnecessary fees.

Wait, you get charged if you over-contribute. Yes. Said another way, you will be taxed. Canada Revenue Agency (CRA) will charge a 1% penalty per month on excess TFSA contributions. Worse, the CRA can also charge a penalty of 100% on any income earned from the excess contributions. So, any capital gains, dividends or interest generated on your TFSA.

CRA has good examples of tax payable on excess TFSA amount here.

Still waiting. I thought you said you were going to explain what is the best method for Canadian Millennials to use their TFSAs?

Oh, right.

Although this is a tough question to answer, I have found that TFSAs are great when used as an investing account especially for millennials. Canadian millennials might hear TFSA as just tax free saving account and believe that they should only use it as a savings account. To probe this idea, I did some research by going to the CRA website. There I discovered something crucial: On CRA’s TFSA landing page, this is the first sentence you will see in bold, get ready for the irony – Saving just got a whole lot easier!

Sure, TFSAs can be used for other purposes and also, depends on your own knowledge about personal finance. Put another way, you can use your TFSA for short term goals such as Emergency fund, travel fund, down payment fund, etc. Those goals are great but I believe we should use our TFSA as a long-term investing vehicle. Canadian millennials using TFSA as an investing account for their retirement, research shows, confer two key benefits: Investing in the stock market gets you the highest return and your income will be tax-free. Would you like to earn 6-8% on your money along with dividends? Or, would you like to earn a meager 0.05% interest in a savings account? I mean, Duh. Second reason: Time. You have 30-35 years until retirement. With some aid from compound interest, your money will grow exponentially. The longer your money is invested in the stock market, you will see more exponential growth. Bridget Casey from Money After Graduation rightly tweeted, “For anyone in their 20’s or 30’s right now, your TFSA can (and should) be over a million dollars at retirement, assuming a traditional retirement age of 65. At a 4% withdrawal rate, this will give you a TAX-FREE income of $40,000 in retirement.” TAX-FREE you guys. So, yes prioritize maxing out your TFSA.

Now, if you don’t want to invest in the stock market. I get it. It is not for everyone. First thing that comes to my mind is read a personal finance book. If not, there are multiple online banks that pay decent interest on a savings account. There are GICs too. If you are interested in an investing newsletter, you can sign up for a free trial here. I have partnered with 5i Research because they have conflict-free research which I believe is important. There is no obligation whatsoever and you can quit anytime.

But ponder the consequences: If your introvert buddy invested his money in the stock market for 35 years and you left your money in a savings account for 35 years. The results will not look pretty. You will lose hundreds of thousands of dollars in your TFSA.

The consequences are grave.

Say it with me now, brothers and sisters: TFSA should be used as an investing account.