I was watching a soccer game this morning and at halftime, I logged into my Facebook account. Bad habit. However, I started watching an episode of AskGaryVee with Tony Robbins as a guest on Gary’s Facebook page. I watched the entire clip which lasted for about 40 minutes. I missed the second half of my soccer game but I found the episode extremely valuable. Robbins rightly said the stock market is in the eighth year of a bull market. Wow, an epic eight-year run indeed. Robbins also reminded everyone a crash is coming as well (But, no one knows when). A crash or a bear market occurs when an index such as our own S&P/TSX falls 20 percent or more. Similarly, a “correction” occurs when the index or stock falls 10 percent to 19.99 percent. Correction tends to happen every year. A crash occurs on average every five years but again, we don’t know when. This bar graph does a good job illustrating the ups and downs of the S & P index since 1956.

Who remembers the last time the stock market went on an eight-year-run? I don’t. If you do, please PM me. The truth is no one can consistently time the market. Please don’t be careless and believe that you can get in and out of the market at the right time. Science has shown again and again it is impossible. Warren Buffett said all the guys in media who are brave to state they can buy and sell at the right time make fortune tellers look good. Urgen agrees with you one thousand percent Mr. Buffett. No one can predict the market. For this primary reason, I believe dollar-cost averaging (DCA) is a smart strategy to follow when it comes to investing your money. DCA does wonder especially if you are a millennial as you can use time to your advantage.

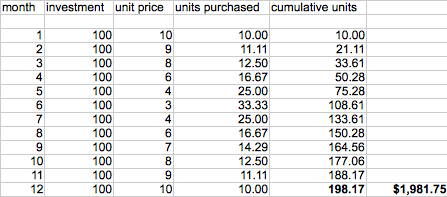

According to Investopedia, dollar-cost averaging is an investment technique buying a fixed dollar amount of a particular investment of a particular investment on a regular schedule, regardless of the share price. Personally, I have been using this strategy for almost seven years now. I love it because it is automatic every month and I am able to purchase more shares when prices are low and fewer shares when prices are high. IDGAF if the market is up or down because I am not touching the money for at least a couple of decades. To be clear, the DCA strategy does not guarantee that you and I won’t lose money on investments. Once you enter the stock market, the risk is always there. The upper hand of DCA is that I don’t have to worry about investing when the market is at its peak. I don’t have to worry about trying to get in and out of the market at the right time. I will leave that to the professionals. Sadly, even the professionals can’t time the market.

Now, some argue that investing a lump sump rather than using DCA is a better investing strategy. Sure, why would you invest at regular intervals (every month) instead of all at once? In fact, this study (It’s in PDF) done by Vanguard found that on average a lump sum investing approach has outperformed a DCA approach approximately two-thirds of the time. But, I am not convinced yet. Ramit Sethi, a New York Times Bestseller does a much better job than me in explaining why DCA strategy works. Sethi explains that if an individual invests $10,000 today and the stock market drops 20% which means your $10,000 is $8000 now. At $8000, the market will need to go up by 25% not 20% – just to get back to your original $10,000. Good luck! Furthermore, Sethi explains by investing over time, you hedge against any drops in the price and if your fund does drop, you will pick shares at a discounted price. I can certainly vouch for this as I have seen it in my own investment as well. I get very excited when I can pick shares at a discounted price. Lastly, Sethi states by investing over a regular period of time, you don’t try to time the market.

Yes, investing a lump sum may deliver better returns but it can also result in higher blood pressure as the risk is higher. As a nurse, I give blood pressure pills to my patients every day. I am not looking forward to be giving blood pressure pills to careless investors. Quick story: I remember when I was waiting for my result after I wrote my nursing license exam. You only get three chances and if you fail three times, you will have to re-start the entire nursing program again. ICK. My blood pressure was definitely a little high during the wait for my license result. It was not fun at all. I had to use gentlemanly websites to “relax” as the wait was too long. I use this strategy once in a blue moon. Show me a guy who has never used this strategy, I will buy you lunch. However, I was fortunate enough to pass the exam on my first attempt.

Dollar Cost averaging is a strategy that is better suited for investors like me with a long-term goal. Again, investing involves risk and nothing is guaranteed. We all should do our own due diligence and understand what we are investing in even if we use the DCA strategy. All of us have a responsibility to educate ourselves about personal finance and investing. Heck, read one personal finance book and you are already ahead compared to the vast majority of Canadians. I am going to end by going back to where I started with Tony Robbins. Robbins said –“You don’t earn a way to your fortune. You make money your slave by investing. No matter how great your business is, you should have a money machine on the right side with no employees, no moving parts that takes 15 minutes a year”. It doesn’t matter if your name is in the sunshine list or you are an athlete making millions of dollars. At some point of your life, you have to let money work for you. The earlier the machine starts, the better. You can’t keep working for money. You can’t be a slave for your money forever. I repeat, make money your slave by investing. Just need 15 minutes a year. Please don’t play the busy card.