Shannon Lee Simmons is a certified financial planner, chartered investment manager, life coach, speaker and the founder of the award-winning New School of Finance. She was named one of Flare’s “Canada’s Top 30 Under 30” and won the Notable Award for Best In Finance. She writes a monthly personal finance column for The Globe and Mail and is the personal finance expert on CBC’s On the Money. Despite her hectic schedule and a 9 month old at home, she was kind enough to do a phone interview with me. This interview was done on February 28, 2018 (Wednesday @ 1900). The duration of the interview was 26 minutes and 8 seconds.

Urgen Kuyee: Hi Shannon, can you begin by sharing your story about how you started The New School Of Finance and also, maybe talk about why you left your Bay Street job at a young age of 25?

Shannon Lee Simmons: Yea, I loved my job when I first started at Bay Street. I was working with high net worth clients, doing private counsel. So, that was great. We were a small boutique firm and at that level of wealth when you are managing people’s money, there’s complete transparency. I was like, what’s wrong with the financial industry? Why does everyone hate on the financial industry? Then, we got bought by one of the big banks.

I learned that when we got bought by the bank that I didn’t also ignore before, what is the service model and how that changes for a client who doesn’t have millions of dollars. And, I was really aware of the fact that there is this demographic with people who maybe don’t have assets under management that can get access to this kind of really good planning, wealth management, really good advice because they just don’t have the money to. But that doesn’t mean they should not be able to get advice. So, that was this huge piece that hit me when I was young.

Also, just coming out of the 2008-2009 crash, a lot of my peers were saying things to me like, “You are so lucky you know all this stuff, I feel so screwed, I don’t know what I am doing.” And, I wanted to help. I left Bay Street in 2010 and my plan was just to leave for one year and do this project called, The Barter Babes Project. I provided financial advice for barter good or service instead of actual money. I was just supposed to do it, get it out of my system and work with the demographic that I wanted to work with and make it fun and exciting for women to learn about money.

Then that project totally took off and completely changed my life. By the end of the project, I was like, I can’t go back. I am addicted to working with this demographic – not only young people, but also people maybe who don’t have enough assets to get really great professional financial advice. So, I started The New School of Finance right after that project. That was in 2012 and here we are six years later. (Laughs)

UK: What is the best thing about working as a fee-only financial planner? What are some of the challenges?

SLS: That’s a great question. I am very transparent about this question. The best part about being a fee-only planner is the ability to look a client in the eye and say, “I have nothing to gain from the advice I am giving you.” I get so empowered by saying that to people because there is a real trust that forms when you are able to give unbiased advice. So, if I am looking at a client’s situation and I may be saying, “Okay we need to invest into an RRSP, or I would actually do this to your TFSA, or we will put everything into a mortgage.” This does not affect my pay check at the end of the day. So, that’s really wonderful to be able to build that trust that I think, just can’t exist in the same way when you are working in a traditional advisor model. So that’s the benefit of being a fee-only from my point of view anyways.

The challenge is the business model. It is so much harder to work. The one thing that’s great about the traditional advisor model is you have sustainable revenue. Once you are managing your client’s money, then you have that income every single year that you can build off it. So, that sustainable business model piece is the thing that is missing from a fee-only because you are kind of always on the hunt for new clients. It is just like being a lawyer, always looking for new clients. Then, once you have a big practise like New School, you are not hunting clients every night because you have a really good rep, you have referrals, that kind of stuff. But at the same time, that takes time. I mean I have been in this business for six years and starting out as a fee-only planner can be really lot of work. It is a long haul. You have to be prepared for a lot of hard work.

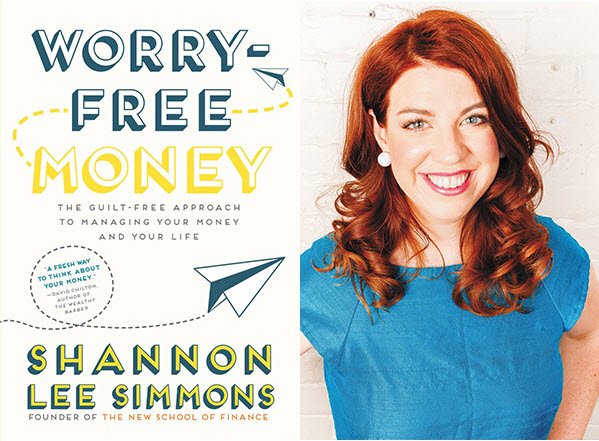

UK: Your book, Worry-Free Money. First of all, a national bestseller. So, Congrats.

SLS: Thank you. I didn’t expect that. I was really excited about it. (Laughs)

UK: Also, I did a quick search on Toronto Public Library this morning and TPL has 111 copies of your book and they are all loaned out and have 173 holds. Clearly, the book is in demand. Huge demand. What led you to write this book?

SLS: Wow. I am beaming. I wasn’t aware of that in the library, so thanks for letting me know. One of the things that made me want to write the book is that because I am a fee-only and affordable, I see a lot of different walks of life. I have some clients who are in debt and barely making ends meet, and then I have clients who are considered high net worth and just want unbiased advice about their retirement planning or want to learn about how to invest or whatever.

So, there is a whole bunch of different types of things I get to talk about and it’s really exciting because it is not the same type of person all the time. And, what was interesting in the last five years especially, maybe even three I found that clients who on paper, were not financially broke. There is a good living wage coming in, maybe they have a little bit of debt but it’s not the end of the world.

Yet words like “worried” and “scared” kept coming up while they were referring to their financial situation. There was this huge unease and nervousness around people that were like, “I am nervous, I don’t know how I am going to be okay.” and this was regardless of what their income or asset were or debt. It was the same fear for everyone and I thought that was really telling and it was just so prevalent in the last three years.

The same idea kept coming up was a lot of that worry was really just a simple question of understanding what I can and cannot afford. That was literally what I would figure out in these meetings. I would sit down and be like, “You don’t know what you can and can’t afford so if you know what you spend, then you don’t have to worry because everything feels scary when you don’t really know.”

After having thousands of conversations with people, I realized that they are kind of saying the same things and have this nervousness about their finances because they are just not sure. So, that’s why I was like you know I am saying the same thing to all these people regardless of their income because they blur the same problem for so many people.

UK: How long did it take you to write this book?

SLS: That’s a funny question. The idea of it and like the nugget of, “I want to do this book,” and randomly writing paragraphs that I thought I will use later and save it somewhere, went on for a year and half. So, just to make that proposal, it took me a year and half. But, then once I got the book deal, I actually was pregnant at the time. I had to write the entire book in four months.

UK: Wow.

SLS: Yeah, that was insane. I wanted to get it done and my publishers, they were so wonderful. They worked really well with me. But I told them I was pregnant. They were like, “Is there any way you can get this book done by the time your due date?” I said I would try. So, the book and the baby were due on the same day. It was a really wild four and half months. (Laughs more)

UK: Over the past 10 years, you have sat down and had thousands of conversations with everyday people to talk about their money as you mentioned earlier. In your book, you talk about how you get to peek behind the curtain into their financial lives and realities. What are some of things people have disclosed to you? I mean no one wants to talk about being broke especially with social media where they post only pictures of their amazing vacation or having a good time. Anyhow, what are some the financial realities people have disclosed to you?

SLS: Yes, that’s not a responsibility I take lightly. It means a lot to me that I get to have these vulnerable moments with people. I think the ones that really hit home are actually some of the examples I put in the book. Like the person who got a massive gift from their family, but they don’t tell their friends because they want their friends to think that they could afford the house they bought. But they can’t really afford the house they bought with the big gift because, the gift helped you actually buy the house but this mortgage is still huge and you are taking on debt.

So, on the surface it looks like everything is okay. You have a house where you are living in it and you got this big gift, which you are so lucky. And behind the scene there is this huge burden of risk of failure, right. You can’t even afford it even with the huge help. They feel like, “I suck, I am the worst, I had all the privilege in the world and I am still failing.” So, that’s hard, that’s a hard pill to swallow.

Also, I have a lot of entrepreneurs and freelancers in my practise. On paper, on their business, on social media, they might have like 18,000 followers and people are like, “Wow they are so good at their business, they must be killing it.” Then, behind the scenes, I actually figured they only make a little bit of money and are struggling to keep it together and pay rent. But, on the surface, they have a staff, they have an office building that they go to and everybody thinks they make so much money but they don’t actually see the reality behind the scenes.

So, most people just see the surface and they have no idea but I have the luxury of knowing the ins and outs. That’s why it was really important for me to put that in, like, “Don’t forget, nobody posts their credit card bill on social media after their vacation, right?”

UK: What are one to three books that have greatly influenced your life?

SLS: I have two. I will give you two answers. The Wealthy Barber by David Chilton was the first personal finance book I ever read when I was young. It was the first time I actually felt like, wow personal finance is actually more about people than it is about numbers. And I think that’s what made me initially attracted to working in the industry because I am a people person at heart.

I love people, relationships and I am really good at math. So I was trying to find a way in my life that I could vary like my social love of people skills with math and numbers, but I kept coming up and I had to be an analyst. I was like ahh. That’s not what I want to do but, yeah reading The Wealthy Barber was such a personalized, story-telling book and it was like, these are people. So, that was a book that had a huge influence in my life from a professional point of view.

In a personal point of view, Margaret Atwood’s The Handmaid’s Tale. I read it when I was 20 years old. It terrified me in the best way. It touches me in such a deep level that you know, in her world, women and minorities, lost their right in a heartbeat overnight in world that was very similar to our current North America. It was just a darn reminder that we always have to stay alert to that and keep fighting. It was the 20th anniversary, it was one of those books I could not put down and it stuck with me. That book just rocked my world.

UK: By the way, I reached out to David Chilton just last week so I could interview him for my blog. He politely declined but he was kind enough to give me a call and leave me a voicemail.

SLS: He is. He also blurbed the front of Worry-Free Money. He said, “A fresh way to think about your money.” I didn’t know him that well.

UK: Yes, I saw that.

SLS: But, he was so kind to do that. I was blown away because he’s kind of like personal finance idol, right?

UK: I agree, he is.

SLS: For him to give a nod and kudos to my first personal finance book, I almost fainted when I heard the news. And, he’s just a really down to earth and lovely human being. So yeah, he’s definitely a financial idol for sure and for so many of us in the industry.

UK: Let’s say a 28-year-old nurse, she makes about 65K/year and wants to save about 10 per cent yearly for her retirement. She comes to see you. Would you tell her to go with a TFSA or RRSP?

SLS: Okay if she is a nurse, she’s probably in a pension plan like HOOPP or something, in Canada anyways. So, if I have someone who comes to me and they wanted to save money aside from their pension plan, I would definitely put it into a TFSA first up to the maximum, and the rest maybe into a RRSP if she has the room.

The reason is down the road for her if she plans to stick it out with nursing, she will have a really great pension on the other side of retirement. When that pension money comes in, that plus CPP plus all these securities will be highly taxable, and anything coming out of her RRSP will also be taxable. So, if we were to invest in her TFSA over these years then she would still be able to draw income from her TFSA, but she would not have to pay tax on it rather than shoving it into her RRSP or whatever room is left there for her and other non-registered accounts.

UK: I am impressed you know about HOOPP.

SLS: Yea, oh my gosh. Well, I see thousands of people right. I know a lot about a lot different industries. I have a neat job. Seriously, I get to peek into the lives of so many people from so many different jobs.

UK: Lastly, what are bad recommendations you hear in your profession or area of expertise? What advice should Canadians ignore?

SLS: What should people ignore? Let’s see. The first one is you need a million dollar to retire. This one bothers me in a big way and I wish that people would ignore it because it is one of those things that everyone talks about and it may be true for a lot of people.

A lot of people do need a million dollars to retire but you know what else, a lot of people need way more than that and a lot of people need way less than that. What I get upset about is when someone just hears that and maybe they can’t get there and it so unrealistic for their life. They feel fearful and feel there is no financial security because it is a very black and white statement.

What you just told someone is if you can get to $600,000, it is not good enough. It is not enough. But that could be definitely enough for them. Everyone is so different. So, that’s one of the pieces of advice that I cringe when I hear it because I know it is freaking out so many people or providing false confidence to others.

I also think one that people should ignore sometimes is that you have to buy a house in order to be financially safe. I agree that owning equity, owning property is a wonderful way to build wealth and for a lot of people, it really did, especially in the last 25-30 years. It is really impossible to look at someone and say it was not the smartest decision they ever made. But, that’s hindsight, first of all.

Second of all, right now we are looking at a job market that’s tightening and there is more precarious work. We are not entirely sure what a lot of our jobs will look like in 20 years from now, which is shorter than a mortgage. And, housing prices are skyrocketing and most people actually can’t truly afford a house. So again when you hear that buy, buy, buy, get in the market, it is only going to go up. It creates this panic and makes people buy houses that they can’t afford because there is this assumption that it is always going to go up forever and your income will always go up forever. I think that was true maybe eight years ago, ten years ago, those assumptions were true but nowadays I don’t know if that is true anymore.

UK: Great. Thank you so much for your time, Shannon.

SLS: Oh my pleasure. It was a great interview.

This interview has been edited and condensed.