Try the following experiment. Walk to your bank branch on a Friday afternoon. What do you see? You see a huge line up. Ew. You wait patiently for 20 minutes and finally, it is your turn. A bank teller greets you with an energetic smile. You are impressed. During the conversation, you smile dutifully at one of his witless jokes. As you are done with your transaction, the bank teller offers you a credit card with zero percent interest for the next six months. Alas, you are not impressed with him anymore.

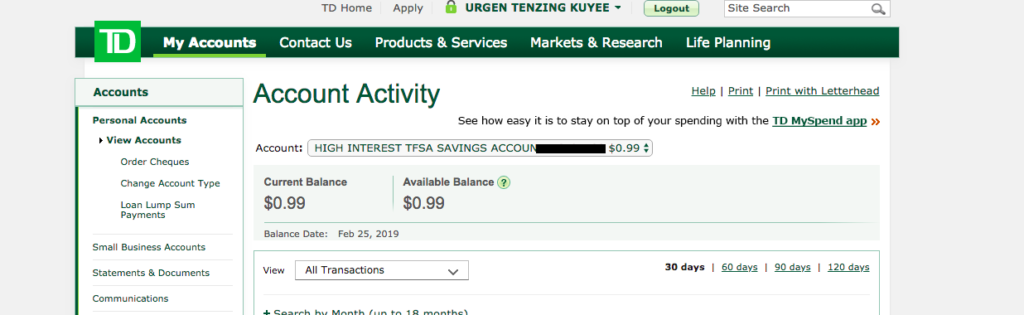

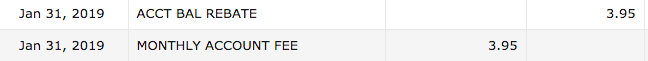

Does this sound familiar? Sure, it does. Banks are not your friends. Banks’ primary goal is to make their shareholders happy. Period. Full stop. They are in the business of selling their products – credit cards, mortgage, line of credit (LOC), insurance et cetera. On top of that, banks hit you with banking fees. WTF? Many Canadians are fed up with paying for banking fees, transaction fees and monthly fees. Rightly so. Now, some will bemoan this fact, wag their fingers in my direction and tell me, I am wrong. Indeed, some will argue that as long as you maintain the minimum monthly balance, your monthly fees will be rebated. Agreed. Then, to their astonishment, they find this. The average Canadian pays $200 a year in banking fees. Choosing the right online bank account can easily save some cash for you and earn more interest too.

Five online banks you should bank with.

EQ Bank: EQ made some noise in January 2016 by pitching in a delicious 3% return on their savings account. I jumped on it. They have lowered their rate since. Personally, I have an account with EQ. Their current savings interest rate is 2.30%. Impressive when I compare it to my other bank which is green in colour. My banking needs are minimal with my green bank. Additionally, no minimum balance is needed and zero monthly fees. Plus, EQ offers unlimited transactions. This does not include Interac e-transfers but you do get 5 free Interac e-transfers per month. I love this feature, as I do Interac e-transfer quite often. I rarely use cheques. I know, I know typical millennial. A drawback for EQ would be there is no debit card or credit card option. There are no bank branches as everything is online. However, it would be unwise to pass 2.30% interest savings rate. If you are saving for short-term goals such as travelling or purchasing a car, EQ is the bank.

Tangerine: Some of you might have noticed Tangerine ads while watching the Toronto Raptors play. I will say the ads are pretty neat and I am a big Raptors fan. Tangerine became the official and exclusive bank of the Toronto Raptors on July 2018. But Tangerine has been one of the major players in the online banking sector ever since Scotiabank acquired it in 2012. Akin to EQ, you will enjoy no minimums, no service charges and no fees with a tangerine savings account. You will also earn high interest on every dollar, every day as mentioned on their website. Tangerine’s current interest is 1.25%. Yes, lower than EQ but it is still better than the rate offered by the big banks. Tangerine does offer debit and credit cards. You will have free access to Scotiabank’s ATM network. Lastly, Tangerine offers investing and borrowing products as well.

Alterna Bank: Most of you probably have never heard about Alterna Bank. I heard about it recently as well. Alterna Bank is an online bank owned by credit union Alterna Savings. Like EQ and Tangerine, Alterna Bank offers a no-fee chequing account. Alterna’s current hight interest eSavings account offers an appetizing 2.35%. Furthermore, Alterna offers unlimited Interac e-transfers. I love it. Unlimited Interac e-tranfers? What an astonishing idea. What a fabulous discovery for those who can’t maintain the minimum balance of 3K or 4K. ATM access is available through The Exchange.

Simplii Financial: Simplii is one of the online players owned by CIBC. Simplii also charges no monthly fees with no minimum balance. You will have free access to over 3,400 CIBC ATMs across Canada. Simplii’s current high interest savings account offers a decent 1.25%. Plus, you can send money for free with Interac e-transfer. Another fabulous discovery. To conclude, Simplii offers investing and borrowing products also.

Motus Bank: Motus is the new player entering the online banking sector. Indeed, Motus has not even launched yet. They plan to launch in spring of this year. On their FAQs page, one of their answer is “Instead of shareholder returns, we’ll focus on offering better pricing and services”. What a grand statement. They plan to offer day-to-day banking, including a no-fee chequing account, a high interest savings account, loans, lines of credit, investments, and mortgages. Please note Motus’ parent company is Meridian Credit Union, which is the largest credit union in Ontario.

All of the five online banks mentioned above are covered by Canada Deposit Insurance Corporation (CIDC), which means they insure up to a maximum of $100,000 – both principle and interest combined. Still not comfortable with online banking? Here’s further proof: More than two-thirds (68%) of Canadians now do most of their banking digitally, using online and mobile banking.

My opinions about Canada’s big banks have not earned me the smoothest of relations with some of my peers that do work in banks currently.

I am profoundly unapologetic about my remarks.

Hi Urgen!

I just read your post and I love it. I like to know in which online bank do you save your money or your TFSA.

Thanks!

Hi Steph, I currently use EQ bank but EQ does not offer TFSA currently. Here I blog about how I use my TFSA + save for retirement http://urgenkuyee.com/2019/09/24/are-you-saving-money-for-retirement/ Additionally, https://www.ratehub.ca/blog/the-best-tfsa-savings-accounts-in-canada/ this post is helpful too.

Good post, thank you! We recently switched from the “Green” bank to Motus. To augment your post with current info, Motus currently offers 2.5% on savings accounts and 0.5% on chequing which are both pretty good I think. Their mortgage rates are also very competitive I find. I’m not sure how other e-banks operate but Motus uses a secure message system for many common requests which is very convenient over picking up the phone to call them, we find them very responsive. When you do need to pick up the phone we’ve never had to wait in queue, maybe because they’re a newer bank with a growing customer base. We’ve been very happy with them so far.

Thank you Robert for your comment. Yes, the more online banks the better as they tend to compete against each other which means better rates for us (clients). I am glad your experience with Motus has been great. Just a word of caution, dont be surprised if they lower their 2.5% on their savings account. I hope they dont.

Correction: 2.25% on savings and 2.5% on their TFSA

Currently getting 4% for 33 months at Coast Capital Savings CU. I don’t put money in “savings” accounts, but rather invest in solid stocks and ETF’s that provide triple the rate of these loser bank accounts !

Too bad Current Capital is only for people who live in BC.

I would suggest that interested persons also look the those Manitoba credit unions that offer online services. (I use Hubert, owned by Sunova Credit Union). In addition to attractive rates and multiple services, deposits are 100% insured by the Deposit Guarantee Corporation of Manitoba.

Tangerine and Simplii pay much higher savings rates than what you quoted. You just have to ask for it. Usually I get 3%. The bonus interest usually only lasts for 6 months so you have to call them again as soon as they drop the interest rate. I would never accept a rate of 2.3% that EQ offers.

Peter, I personally dont bank with Tangerine or Simplii but thank you for sharing. Others will benefit from it.

Royal Bank was offering 3% in their savings account in the autumn but they stopped accepting new accounts after a couple of months. I don’t quite understand why since I’m sure that they are paying higher rates with their preferred shares but my guess is that the management people at Royal know what they are doing.

just called Tangerine where I have $50,000 in savings accounts and I offered to move another $60,000 and they said they can do nothing for me. The posted rate is 1.25% and that is what I can get. So I am looking elsewhere. They do have a posted rate of 3% for new clients but they would not extend that to me.

I moved my money from Tang because they lowered the rate. Tang is supposed to get back to me next week with a new offer. Simplii also has nothing good right now, like Cheryl said. I use Oaken (Home bank and Home trust for GICs. I think they are lowering their rates next week for new people. All this stuff can drive one crazy.

Hi Peter,

How do you ‘usually’ get 3% from Tangerine & Simplii? Even when a limited-time higher interest rate offer ends & a call is made, a ‘new’ rate may be be offered, but it rarely is close to 3% in my experience. I’d be interested in knowing how you negotiate to get this high rate?

The way to negotiate with Tangerine. When the customer service rep does not offer you what you’d like, ask to have a bank rep with greater flexibility contact you. I have always received a call back, usually within 3 business days, and I’ve always received a bonus rate that exceeds what any other bank is offering. I don’t know what the parameters are, but I’d suggest you have to be a longer term customer and/or have an account above some threshold.

Thanks Joe, appreciate that! I have a rate promo ending next week with Tangerine and will use your suggestion. I will update this comment once I negotiate my new rate. Cheers!

Taking the above suggestion, I did receive a call back from a Tangerine rep within 48 hrs. The best rate I was offered 2.5%.

That’s what I got too. Rates are going down.

1. While running two small businesses for 40 years, I always lived by your statement: “The bank is not your friend”.

2. I have only dealt with a credit union for the last 30 years, my wife and I and the two businesses Their current savings rate is 1.6%. Not bad. But I don’t use it much. There are no lineups although they operate as a full service bank but with free chequing and no fees except for the business accounts. They do not make business loans, but do write mortages. As a senior, $US and $C bank drafts are free. They also have branches with ATM machines but not many. I do all my banking on line with them, for the businesses too. I only visit annually.

3. But here’s the joke: Most of my investments are in bank shares! They are screwing everyone and sending me the dividends.

David

PS. I think an RRSP is a big government rip-off. More if you are interested.

Thank You David for your insightful thoughts. I agree with you one thousand percent especially # 3. Bank shares are awesome!

Hi David,

Interested in hearing more about “RRSP is a government rip off”. I just don’t know any other way to lower tax owed. I had rental income for the first time and instead of paying taxes owed I got RSP. There is no other choice. Interested in your comments.

Good round up of online banks. Entertaining blog post also.

Thank you Gord. Appreciate your support!