Recently, I started following Bridget Casey on twitter. I followed her so I could learn more about personal finance. Unfortunately, her recent tweets have all been about her baby and her search for a nanny (which I don’t mind). Plus, I am extremely jealous of her majestic abs. I came across her post – 20 things you need to know about money in your 20’s and I was like Uh-huh. I vividly remember how naive I was with my money in my early 20’s. Gosh. If you are in your 20’s, you might be in the same boat. But, help is here and this is the perfect time to start getting serious about your money. I hope the 5 tips I share in this post will come in handy for you in the near future.

Don’t burn your money

Hello Narcos fans. You know Pablo Escobar and his family is always running away from the cops and hiding in different houses. There is a scene in season 2 where Escobar and his family are doing the usual, hiding from the police but this particular scene was amazing. This house has no food, no wood for fire and Escobar’s wife and his kids are cold. Sadly, Escobar’s men can’t find any wood for him. Then, Escobar does what a drug lord would only do. He uses stacks of cash to make a fire and keeps his kids warm. You can watch a 19 seconds clip of Escobar burning cash here. Yup, that scene was shocking to say the least (Spoiler alert: This will never happen in real life). In real life, you need to must spend less than what you make. As soon as you land your first job, you might have the temptation to burn your money by buying a new car, going on exotic vacations and purchasing designer clothes. Arretez! All these purchase will only lead to more debt. In your 20’s, you will feel the urge to appear beautiful, wealthy and strong but your wallet might say otherwise. If you don’t burn your money in your 20’s, you can achieve your savings and retirement goals with more ease. And, if you don’t watch Narcos, WTF?

Outsmart the banks

Canada’s 5 big banks – BMO, TD, Scotia, CIBC and RBC love charging fees to their customers and continue to enjoy big profits. Don’t forget, they are a business and will generate revenue through us. Loyal customers, haha. Heck, all 5 banks have kept on increasing their monthly checking account fee. You can only skip the fee if you maintain a certain amount of balance ranging from $1500 to $3500, depending on the account. I call this BS (BS stands for Boy Scout). When you are in your 20’s, you might not be willing to negotiate with your bank but that’s a huge mistake. You should always negotiate in life especially with your banks. For example, when I was paying my student loan back, there was no way I was able to maintain the minimum $2000 in my checking account to avoid the monthly fee. I went to my bank and let them know my situation. They could see all my hard earned money from nursing was going straight to eliminate my OSAP every paycheck. The bank manager reimbursed my monthly fee for the next 6 months. This took me less than 5 minutes. Another personal experience was I had made a money draft and I had to pay around $12 I believe. I was trying to be frugal like always instead of ordering a bunch of personal checks. Well, it backfired. I could not use the money draft. Again, I went back to the bank and explained my situation. I played dumb and said this wont happen again. I was very polite too. I got my $12 back. It took me less than 2 minutes. Magic. I shit you not, banks are not your friends. Remember, banks’ primary objective is to make money for the shareholders, not to help their customers.

Open an account with online banks

In my early 20’s, I never knew much about online banks. Even when I heard about them, I found them suspicious. I didn’t know about Canada Deposit Insurance Corporation (CDIC). So, I never tried online banking. Rookie mistake. The truth is Canada’s online banks are growing not only in number of competitors, but also in services offered. Online banks such as Tangerine, EQ bank and Zag bank offer higher interest rates on savings account. When I opened my account with EQ, they were offering a delicious 3% on their savings account. Obviously, it was a teaser rate and has since lowered their rate to a still-impressive 2.25%. Also, you can say goodbye to monthly fees when you open an account with one of the online banks. However, please be aware there are some drawbacks with online banks. For instance, you wont have access to an ATM with EQ. Everything is done online. (My primary bank is TD so yes I do have access to ATM. I love the krrrrr sound when I am withdrawing money to eat chicken wings. OMFG I am so funny). With tangerine, you can use the Scotia bank ATM. Further, online banks’ website and system can go down like it happened with EQ recently.

Some EQ customers were frustrated as they were not able to pay their bills on time due to the issue and had to pay late fees. Personally, I feel you are taking a small chance with a no bricks and mortar bank. I use EQ to park and save my money. They still have the best interest. Additionally, EQ stated they would reimburse the ones affected by late fees. Viola. Online banks are an excellent alternative for short term savings goal as well.

Invest your money

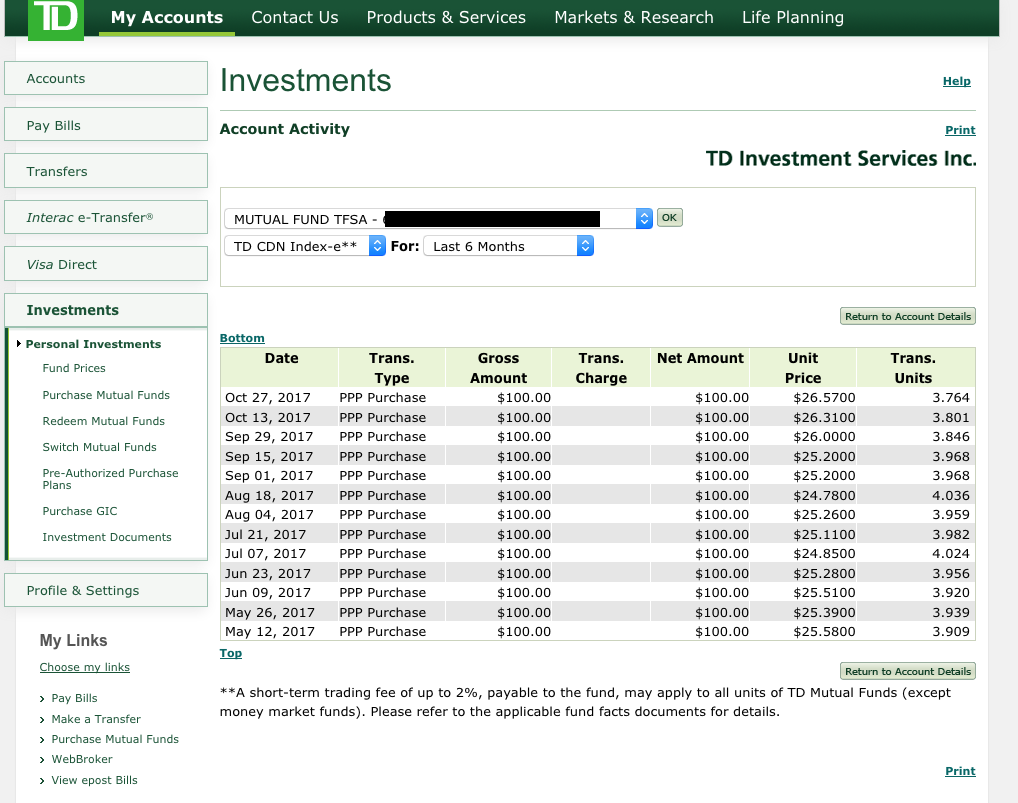

The earlier you start investing your money, the better results come retirement time. When you are in your 20’s, you have to take advantage of compound interest (CI). For those who don’t know what compound interest is, let me explain. First, you are a loser. CI means earning a return not only on your original investment but also on the accumulated interest that you reinvest. For instance, if 100$ attracts 10 percent interest in one year, then we know it gained $10, turning $100 into $110. You would start the second year with $110, and if it increases 10 percent, it would gain $11, turning $110 into $121. Compounding works its magic after every year, you get the point. Investing early is the greatest gift you can give yourself. Warren Buffett used CI to become a billionaire. Buffett bought his first stock when he was 11 years old and the multibillionaire jokes that he started too late. He is such a teaser. Personally, I have been investing with TD Bank’s e-series index fund (Fund code – TDB900) for over seven years now using dollar-cost averaging (DCA) strategy. You can read my blog post about DCA here which was featured on the globe. I smile as I collect my dividends every December. Sorry, I re-invest it to my fund. Fun fact: My dividend income has been increasing every year for the past 7 years.

If you think, investing $100 bi-weekly is too much. Relax. You can start with as little as 25$/month. Heck, that’s how I started my first year. Then, I increased it to $50/month and now, I invest $100 bi-weekly. And, if you think investing $100 bi-weekly is for losers. Good job, I am happy for you. I lied. Fuck you.

Start a side hustle

I am and always will be a huge advocate for saving money and cutting out expenses but you can only save so much. There is always potential to earn more money and you can start in your 20’s to do that. Side hustle is something you do beside your primary job to earn more money. There are numerous ways to earn more money but from personal experience, I would advice to start a blog (By the way, starting a blog has been one of the best decision I made in my life). After close to a year of blogging, I got a random message on my LinkedIn. The message read something like – Urgen, can you write a blog post for our company and we will pay you $200. I took a deep breath, smiled and sent an email to Ellen Roseman asking her about how freelance writing works. Then, I replied – Are you willing to pay me more? I started to negotiate which I mentioned earlier is so important. Long story short, the company didn’t pay me more but did pay me $200 for that article and that was how my journey started as a freelance writer. I believe it is just human psychology but once someone pays for your work, you just become 1000 times more confident. Today, I get paid every month to write blogs in my pajamas while eating nutella straight from the jar. I don’t think I will ever stop blogging and writing. Writing has helped me to stay creative and has opened new doors for me. Also, I have plans to quit working as a nurse in the next 5 years or so. That is my goal. In any case, start a side hustle. Go ahead, I can wait while you think of something creative to start your own side hustle

I am aware this post will attract attention and criticism as I am expressing my personal opinion. Criticism = No Problem. Attention = Icing on the cake. Lastly, I hope you enjoyed the BS stands for Boy Scout joke on paragraph 3. I was proud of that one.