Imagine you are driving to work. You see that the traffic light turned red. What do you do? You step on the brake and stop the car. Then, you start to cry because you can see your belly flab coming out via your seatbelt. (If you ever see me crying on a red light, you know why now). In a similar vein, you see that the traffic light turned green. What do you do? You step on the gas and make it safely through the intersection. Now, imagine you have not have saved a dime for your retirement. What do you do? Nothing. Instead, you might say peculiar sentences like – “Oh, retirement is still 35 years away”, “What is the rush?”, “Let me have fun first. YOLO”. Really?

Look around. I see more and more seniors working everywhere these days. I have seen it in nursing first hand. I see more seniors working in retail stores, fast-food joints, public libraries, local banks and the list goes on. Let’s not forget the 76-year-old Walmart greeter. Not fun. I know a co-worker who is 68 years old and cannot retire because she does not have enough money saved. She is working full time, doing night shifts and day shifts. She would love to retire. Heck, she would love to work part-time or causal but she does not have that option. Heartbreaking. She only shared this story with me because she knew I ran a personal finance blog. Her eyes got teary during this conversation. This was an embarrassing revelation. I tried not to betray any emotion because I was supposed to help her but my heart was racing.

Here’s further proof. There is evidence in numbers. According to Statistics Canada, in 2015, one in five Canadians aged 65 and older (nearly 1.1 million seniors) reported working during the year. This is the highest proportion recorded since the 1981 Census. Sure, some seniors may choose to work to stay active and socialize. JSYK: There are more fun ways to stay active and socialize. Here’s the punch line: employment income was the primary source of income for 43.8% of Canadian seniors who worked in 2015. Further, employment income was the main source of income for 70.3% of seniors who worked full time, up from 62.1% in 2005 and 56.7% in 1995.

Quick translation: Canadian seniors who choose not to save early, choose to stay in debt and choose not to save enough money paid the price.

The good news? You can learn form my co-worker’s mistake and start saving for retirement today. It is never too early to start saving for your retirement. Saving early has two pivotal benefits: 1) You can save less each month and 2) You will have more time and your money will grow more due to the magic of compounding return.

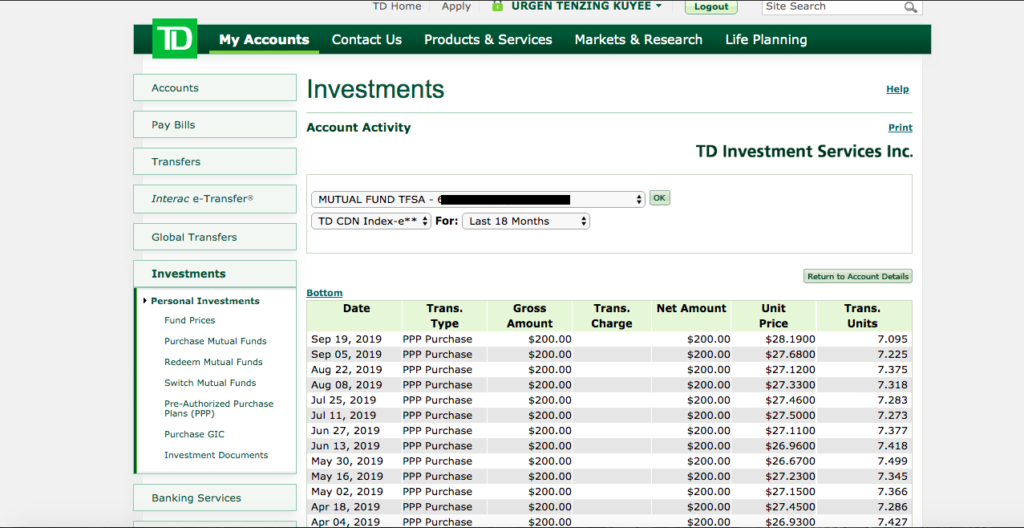

Personally, I started saving (investing) nine years ago. I started investing as little as $25/ month under my TFSA. You need to start somewhere. Then, I increased it to $50/month, $100 bi-weekly and now, I invest $200 bi-weekly. I am thinking of increasing it to $300 bi-weekly very soon. Majority of my portfolio falls under my TD e-Series Canadian index fund. Further, I have some portion of my portfolio with individual stocks – Dollarama and SNC-Lavalin under my TFSA as well. I use Questrade for my individual stocks’ portfolio.

Furthermore, I truly believe automating your savings and investing makes life much easier. I automate my retirement savings. Investing $200 bi-weekly or any amount on automation sweeps away foggy notions like “I want to start saving for retirement next year” or “I cannot save enough money”. Alternatively, it works like magic for your retirement fund. The mantra I find useful is “Automate your savings and investing”.

As this blog post draws to a close, I hope I have convinced you the importance of saving and investing money early for your retirement.

More importantly, beside money, you should also plan for a healthy retirement. The healthier you are, the more you will enjoy your later stages of life and retirement. You can have enough money but if you are stuck in a wheelchair at 65, what’s the point? (Side note: However, please be aware and understand that having money in your bank account will make your life way more easier. Money is important. Don’t fool yourself). In nursing, I have seen numerous patients in their mid 50’s and 60’s struggling to stand up without assistance. More, they need a walker to walk a mere 50 meter. I get it. Life is hectic. But, when you are young, you need to take care of your body, get strong and fit. Akin to saving money early for retirement, work on your body and mind today. A tiny list can look like –

Get 8 hours of sleep

Fast 16-18hrs/day

Lift/Exercise 3x per week

Cut alcohol

Cut Sugar (This is really hard. We all say we are going to cut sugar but when the dessert tray comes along, we all go for the cookies LMAO)

Say no to things you don’t want to do

Practice gratitude

Do Hill Sprints/ Sand Sprints

Stay away from negative people

Spend time around high functioning people and copy them

Visit the Library 3x per week

Imagine the year 2055. You are 69 years old. Do you want to be playing bingo stuck in a wheelchair or do you want to be playing tennis with your grandkids?